Don’t Forget: Unemployment Benefits are Taxable!

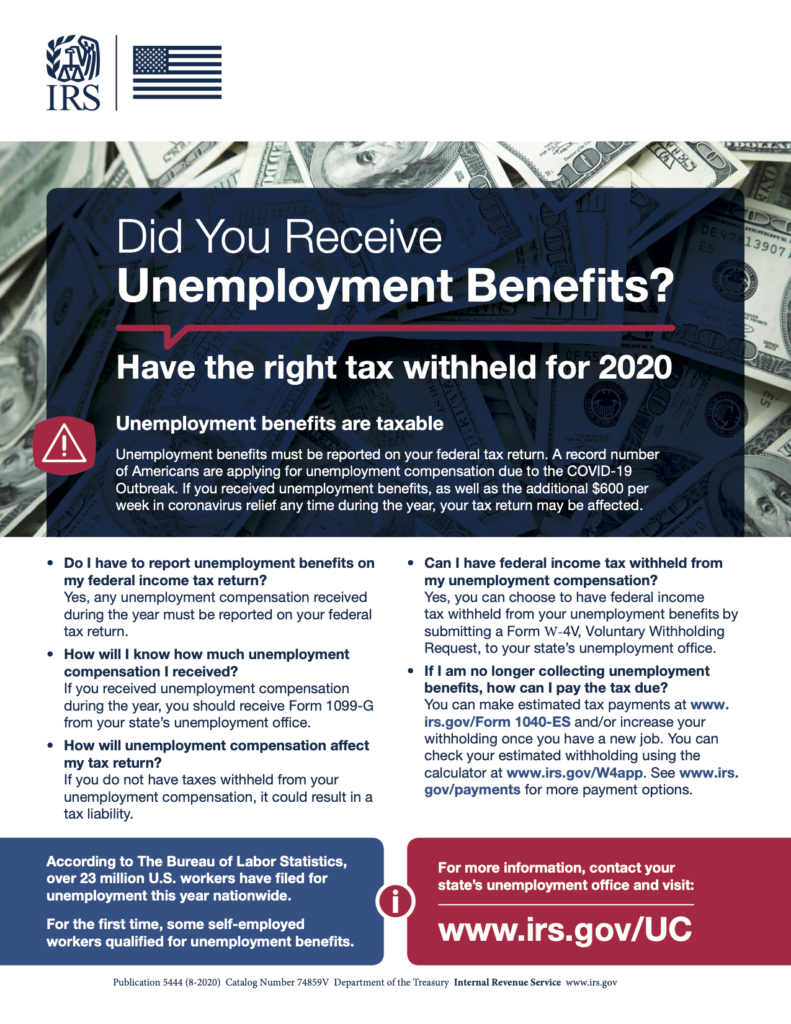

Do you know anyone who has claimed unemployment this year? As of April 2020, over 23 million Americans filed for unemployment, and one out of four Americans received unemployment this year.

Taxable benefits include any of the special unemployment compensation authorized under the Coronavirus Aid, Relief, and Economic Security (CARES) Act, enacted this spring. We do not want them to be caught off guard when filing their tax return next year!

Although some states don’t tax unemployment, it is always taxable at the federal level. The State will provide taxpayers with a paper Form 1099-G or make it available electronically by January 31st showing the amount of taxable benefits paid.

Download the flyer HERE. This publication will be available in Spanish, but it’s not available at this time. Please check IRS.Gov for the latest updates.

See this additional publication for more information: Publication 4128 Tax Impact of Job Loss – the Life Cycle Series (Rev. 05-2020)

Leave A Comment